This week, a 45-page report from the Securities and Exchange Commission takes a detailed look at the situation and concludes that, while “short sellers covering their positions likely contributed to increases in GME’s price… a short squeeze did not appear to be the main driver of events.”

Thereof What is a stock squeeze? The term “squeeze” is used to describe many financial and business situations, typically involving some sort of market pressure. … In the financial world, the term is used to describe situations wherein short-sellers purchase stock to cover losses or when investors sell long positions to take capital gains off the table.

How much of GameStop is still shorted? Short interest is the volume of GameStop shares that have been sold short but have not yet been covered or closed out. As of November 30th, investors have sold 6,420,000 shares of GME short. 10.23% of GameStop’s shares are currently sold short. Learn More.

Regarding this How much is GME still shorted? GME shares shorted are now 27.13 million.

Is short squeeze illegal?

Short squeezes are illegal.

Any brokerage that knowingly allowed a short squeeze to continue without taking action, could have potentially massive legal liabilities.

Also Know Where can I find squeeze stocks? Scanning for a Short Squeeze

- The number of shares short should be greater than five times the average daily volume.

- The shares short as a percentage of the float should be greater than 10%

- The number of shares short should be increasing.

Are short squeezes illegal? Short squeezes are illegal.

Any brokerage that knowingly allowed a short squeeze to continue without taking action, could have potentially massive legal liabilities.

identically Do short squeezes work? Who Loses and Who Benefits From a Short Squeeze? Speculators and traders who have short positions in a stock will face heavy losses if the stock undergoes a short squeeze. Contrarian investors who have built up long positions in the stock in anticipation of a short squeeze will benefit as the stock price climbs.

Is Tsla a meme stock?

That makes trading TSLA stock a tricky proposition. Its unique status among meme stocks is because of Elon Musk. So, you could probably see more rallies along the way.

Also What is a float stock? A stock float is the total number of shares that are available for public investors to buy and sell. It may be expressed as an absolute figure such as 10 million shares, or it may sometimes be expressed as a percentage of the company’s total outstanding shares.

How long does a short squeeze take?

For instance, if you take 200,000 shares of short stock and divide it by an ADTV of 40,000 shares, it would take five days for the short sellers to buy back their shares.

What is a gamma squeeze? In investing, a “squeeze” happens when there are swift movements of a company’s stock prices. … A gamma squeeze is usually extreme, forcing investors to buy more stock due to open options in the underlying stock.

Is GameStop going out of business?

GameStop isn’t dying yet, per se. They’re still a multi-billion dollar business. But their niche in the industry is shrinking, and it will eventually be nonexistent.

as a matter of fact What was the Tesla squeeze?

In the case of Tesla, the stock soared, setting up a so-called “short squeeze.” As the stock price begins to rise, investors betting against the stock are forced to buy shares at a loss in order to cover their short positions.

Why does the SEC allow naked shorting? Naked Short Selling Regulations

The SEC’s primary objective is to protect the interests of investors. It’s this objective that led the SEC to ban the practice of naked short selling in the U.S. after the financial crisis of 2008. As explained in Regulation SHO, naked shorting creates a risk of “fails to deliver” (FTD).

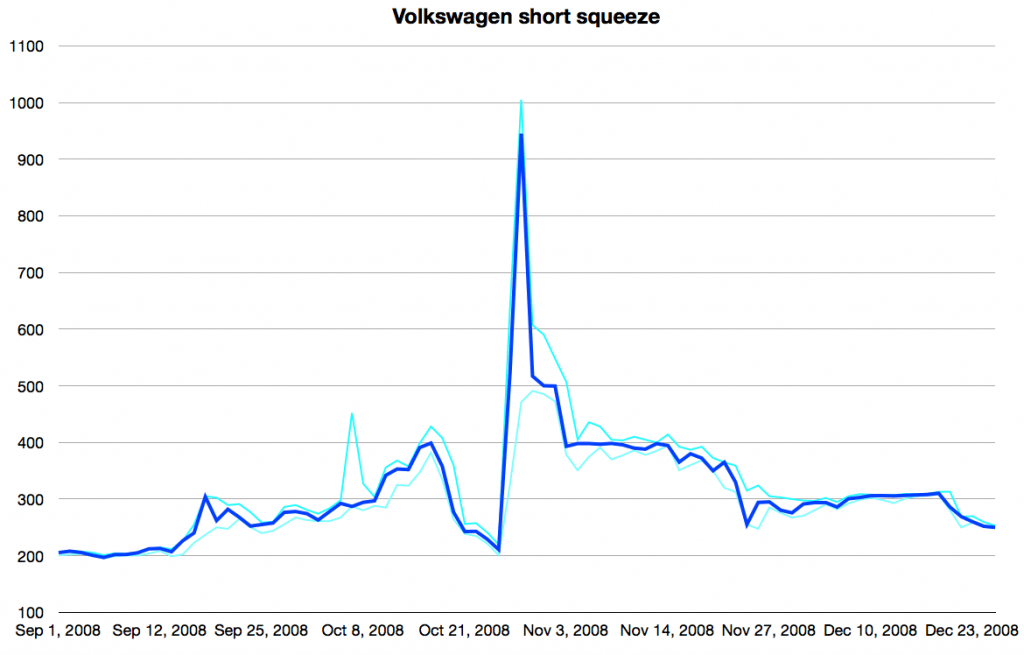

What was the biggest short squeeze ever? One of the greatest short squeezes in history started on a SubReddit, where hundreds of thousands of retail investors banded together to drive the price of GameStop shares up to an all-time high of almost $500. Before the surge, GameStop’s stock had been valued at $17.25.

How do you profit from a short squeeze?

If a short seller thinks a stock is overvalued and shares are likely to drop in price, they can borrow the stock through a margin account. The short seller will then sell the stock and hold onto the proceeds in the margin account as collateral. Eventually, the seller will have to buy back shares.

How do you tell if a stock is being shorted? How to Determine whether Your Stocks Are Being Sold Short

- Point your browser to NASDAQ.

- Enter the stock’s symbol in the blank space beneath the Get Stock Quotes heading. Click the blue Info Quotes button underneath the blank.

- Choose Short Interest from the drop-down menu in the middle of the screen.

How do you tell if a company is being shorted?

For general shorting information—such as the short interest ratio, the number of a company’s shares that have been sold short divided by the average daily volume—you can usually go to any website that features a stock quotes service, such as the Yahoo Finance website in Key Statistics under Share Statistics.

What is the most shorted stock? Most Shorted Stocks

| Symbol Symbol | Company Name | Float Shorted (%) |

|---|---|---|

| LGVN LGVN | Longeveron Inc . | 45.95% |

| LMND LMND | Lemonade Inc. | 35.78% |

| ICPT ICPT | Intercept Pharmaceuticals Inc. | 35.39% |

| BYND BYND | Beyond Meat Inc. | 34.29% |

Does rivian plan to go public?

Rivian is an EV manufacturer and provides related accessories and services. Rivian went public under the ticker “RIVN” on Nov. 10, 2021 at an initial offering price of $78.00.

Is Polestar on the stock market? Upon closing of the reverse merger, expected in the first half of 2022, the new public company, Polestar Automotive Holding UK Limited, will be listed on the NASDAQ market under the ticker symbol PSNY.

Is rivian overvalued?

If you bought shares of Rivian Automotive (NASDAQ:RIVN) at or near its peak in mid-November, it’s been a bad couple of weeks for you. It’s going to be a while before Rivian starts seeing significant revenue, so the stock price is already artificially inflated. …

Is low float good? Low float stocks are a subject of great interest for day traders as they are a very good tool for earning continuous profits throughout a single trading session. Due to the fact that low float stocks are very short numbered, they tend to go up and down in price very easy and quickly.

Is high float good?

Stocks with a high float tend to be more predictable and less volatile. For all intents and purposes, you can expect a stock to be a “high float stock” with anything above 100 million available shares. Due to the large number of shares in the float, the liquidity can absorb any big moves.

What is a good float?

Investors typically consider a float of 10-20 million shares as a low float, but there are companies with floats below one million. Some larger corporations have very high floats in the billions, and you can find even lower-float stock trading on over-the-counter exchanges.

Don’t forget to share this post with your friends !

Leave a Review